who pays sales tax when selling a car privately in florida

Do I have to pay sales tax when I transfer my car title if the car was given to me. According to the Florida Department of Highway Safety its best to complete the transaction at the tax.

Bill Of Sale Template Free Bill Of Sale Form Lawdistrict

Florida collects a 6 state sales tax rate on the purchase of all vehicles.

. No discretionary sales surtax is due. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Its illegal in Florida to sell a vehicle privately with an existing lien.

Sale of 20000 motor vehicle to a. Or private tag agency. Answer 1 of 9.

You pay 1680 in state sales tax 6 of 28000. Motor vehicles is 7. To sell the motor vehicle the lien first has to be satisfied.

Florida sales tax is due at the rate of 6 on the 20000 sales price of the vehicle. You can sell a car without tax. For vehicles worth less than.

Who pays sales tax when selling a car privately in Illinois. But a car lien may affect the auto insurance coverage youre required to carry as well as the sales process if you decide to sell your car. That depends on the sate and the laws regarding sales tax.

In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing in. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida collects a 6 state sales tax rate on the purchase of all vehicles.

However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in. You will pay less sales tax when you trade in. A private seller does not have the responsibility to collect sales tax from the purchasing party unless of course your income is derived from.

For example if you decide to sell. The buyer will have to pay the sales tax when they. All of the conditions that apply when buying a vehicle from an individual in a private sale also apply when buying inheriting or being gifted a vehicle from a family member.

Floridas general state sales tax rate is 6 with the following exceptions. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership.

Tax Department Of Motor Vehicles

How Do You Write A Bill Of Sale For A Mobile Home In The State Of Florida

Despite Warnings Florida Could Give Car Dealers More Time To Turn Over Titles

What Is Florida Sales Tax On Cars

Florida Car Sales Tax Everything You Need To Know

Motor Vehicles Lake County Tax Collector

Car Tax By State Usa Manual Car Sales Tax Calculator

Florida Vehicle Sales Tax Fees Calculator

Bill Of Sale Form Free Bill Of Sale Template Us Lawdepot

Florida Vehicle Sales Tax Fees Calculator

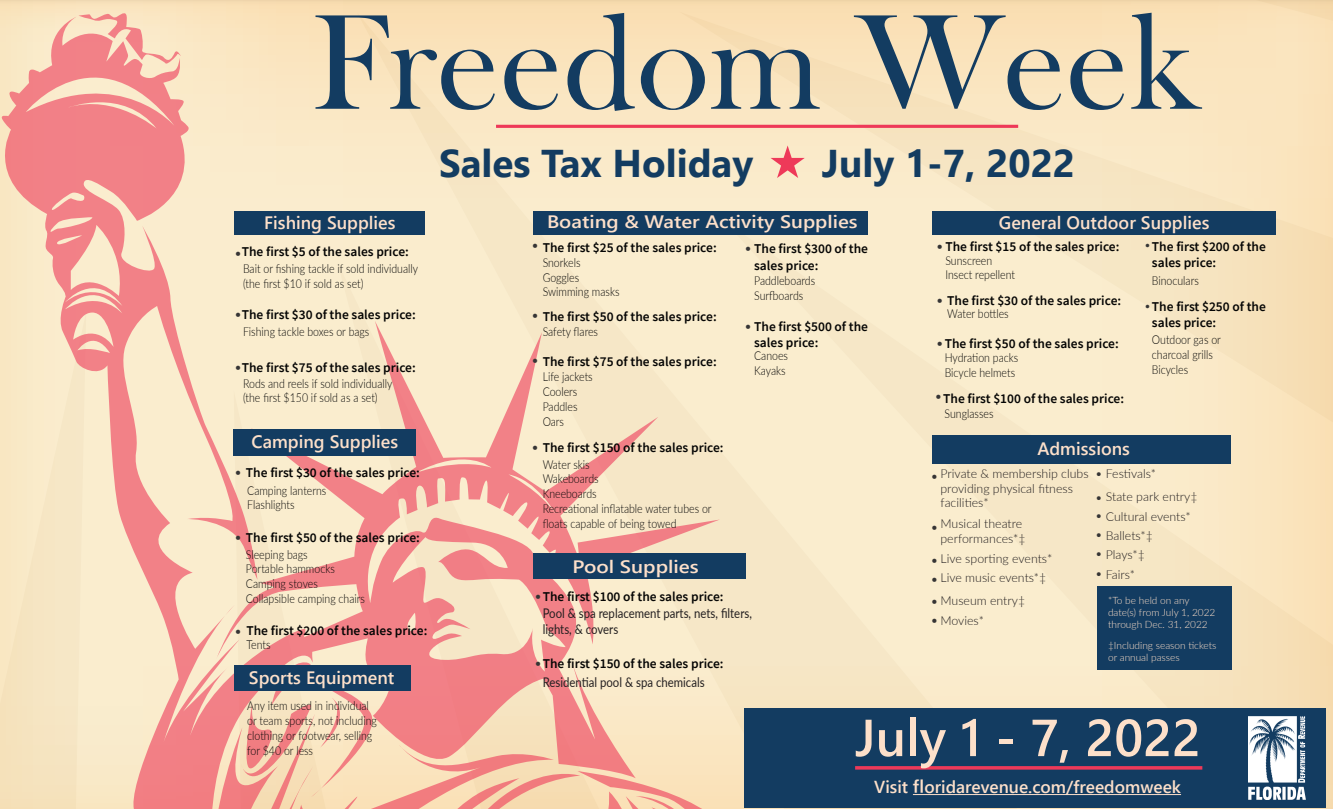

Freedom Week In Florida Here S What You Can Buy Without Paying Sales Tax

How To Close A Private Car Sale Edmunds

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Selling A Car In Florida A Former Dealers Advice

Selling A Car In Florida A Former Dealers Advice

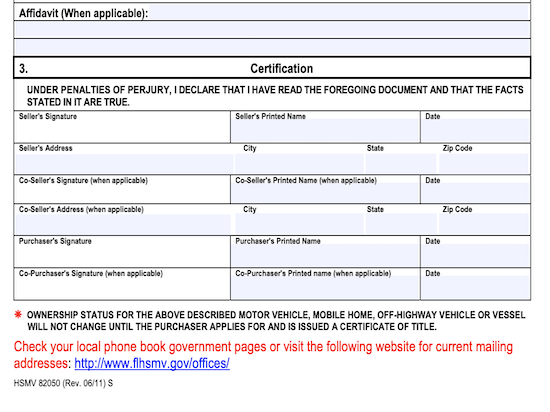

Do You Need A Bill Of Sale To Transfer Title In Florida Etags Vehicle Registration Title Services Driven By Technology

How To Write A Contract For Selling Your Car Yourmechanic Advice

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

What S The Car Sales Tax In Each State Find The Best Car Price